New research shows Britons support protecting the future of cash with 80% of people agreeing they have – or should have – a right to pay in shops with cash.

- Consumers want cash to be protected with 80% of people agreeing they have or should have a legal right to pay in cash when shopping

- Looking ahead, 54% think they will use cash the same or more – with 59% of Gen Z and Millennials (18–34-year-olds) and those lacking financial confidence showing the strongest preference

- Over a quarter (28%) of people whose cash payments were refused went to another retailer or did not buy the goods or services at all

Cash free world is not popular with Britons

The research reveals that despite a decline in cash and coin use since the pandemic started, as normal economic life returns, so too is the desire to use cash. Over half of the population (54%) see themselves using cash either the same or more in the future: with the youngest age groups (18-24 and 25-34) being the most likely (59%).

The survey highlights why cash remains an important choice for many for three main reasons:

- Financial resilience, with72% agreeing cash is good to have in times of crisis

- Manage finances, with a quarter (28%) saying budgeting is a key reason after convenience and habit

- Security cash provides with 52% considering cash the most secure payment method

Paul Ogle, Managing Director, Coinstar UK and Ireland, comments:

“During the pandemic many shoppers weren’t able to use cash in the way they wanted. But our research confirms that this hasn’t dampened the desire to come back to it. With eight out of ten people wanting the right to pay in cash, businesses should see cash acceptance as a golden opportunity to keep customers and remain competitive. This isn’t only about protecting consumer choice, but safeguarding an important option for managing finances and the added sense of security that cash provides.”

Young people are still paid in cash

The findings also challenge some assumptions about younger people. Particularly the 18–24-year-old group, of whom over a fifth (22% compared with 10% of all age groups) reported they are still paid in cash.

- It was the youngest age groups who reported they are about the same, or more likely, to be using cash in the future (18–24-year-olds, 59%; 25-34, 59%; and 35-44, 59%)

- Whilst cash is considered the most secure form of currency across all age groups, those up to age 44 are significantly more likely to see digital currency as secure (20%-21%) compared with 17% across all age groups

- “Helping me budget” was a key reason for using cash over other transaction methods. This is particularly true in the youngest age group (18-24) with 32% saying it helps with budgeting, compared with 16% saying the same in the oldest age group (65+)

- During lockdown, compared with other age groups, more 18-24 year olds reported they tried to insist on paying with cash (43% vs 25% overall) and felt frustrated that they could not pay in cash (58% vs 37% overall)

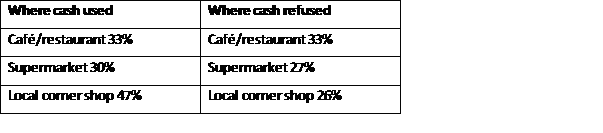

The survey confirmed that during lockdown, retailer refusal was a notable driver preventing those wanting to pay by cash. During the pandemic 62% were refused cash use or discouraged from using it, and 32% of consumers were told outright they could not pay in cash. When cash was refused over a quarter (28%) either went to another retailer or did not buy the goods or services at all: half (51%) used another payment method.

The future of cash

Looking to the future, people expressed a strong preference for ensuring that cash use remains possible and simple. More than three-quarters agree that they should have the right to pay in cash in shops (80%) and use cash in any transaction (78%). 7 in 10 (70%) people are opposed to the phasing out of all coins; around half (47%) of people oppose phasing out 1p and 2p coins. 64% also agree that notes and coins are important to our shared national identity.