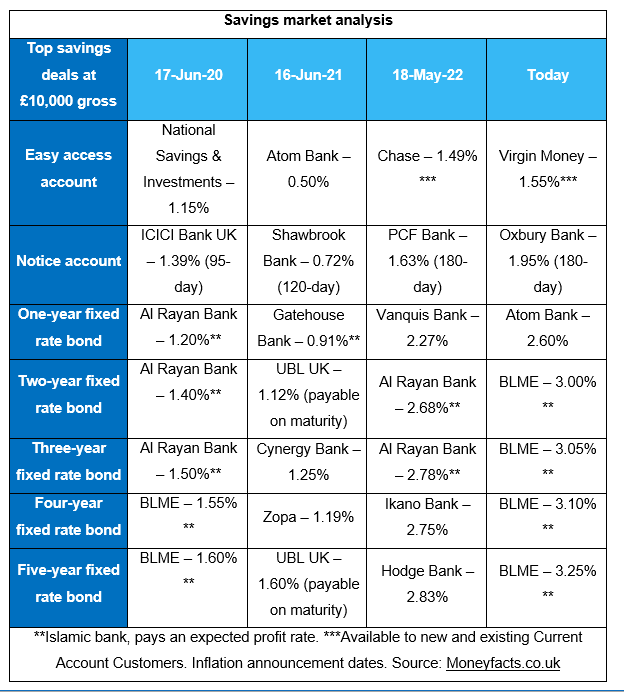

Top savings deals are on the rise across various sectors, as providers compete for a place in the spotlight. Moneyfacts.co.uk reveals the top rate deals available to savers searching for a competitive return to ease inflation’s force.

Money facts reveals the top rate deals available to savers searching for a competitive return.

Consumer Price Index rises to 9.1%

- The Consumer Price Index (CPI) rose to 9.1% during May, from 9.0% in April.

- The number of deals able to outpace inflation has not changed since last month. There is not one standard savings account that can outpace 9.1%*.

- The predicted rate for inflation during Q2 2023 is 6.6%.

- In June 2021, there were no deals that could beat 2.1% (May 2021 CPI) and in June 2020, there were 440 deals (35 easy access, 38 notice accounts, 31 variable rate ISAs, 96 fixed rate ISAs and 240 fixed rate bonds) that could beat 0.5% (May 2020 CPI)*.

Savings market analysis June 2022

Savings rates are not rising very quickly but they are starting to change so it is a good time to start your research to find the best providers. Here are some excellent rates we found as of 28th June 2022. (All these rates were found independently without any compensation).

Regular Saver – First Direct

We found First Direct offering 3.50% on it’s regular saver account.

Regular eSaver – Santander

We found Santander eSaver paying 2.50% gross fixed for 5 years

Regular Saver – Natwest

Natwest are paying 3.25% gross (3.30%up to £1000) on their regular saver account

Fixed rate bond – Yorkshire Building Society

We found YBS paying 2.10% on fixed rate bonds

Fixed rate bond – Nationwide Building Society

3 year member bond paying 2.50%

Loyalty Bond – Coventry Building Society

Rate for loyalty bond 3.00% gross per annum fixed until 31 August 2024

Fixed Bond – Coventry Building Society

Fix rate bond of 2.75% gross per annum until 31 August 2025

Limited Issue 30 Month Fixed Rate ISA – Leeds Building Society

We found 30 month fixed rate ISA 2.75% per annum

ISA Savings Rates June 2022

Rachel Springall, Finance Expert at Moneyfacts.co.uk, said:

“Inflation is eating its way into the real spending power of consumers’ cash and there is not one cash savings account that pays anywhere close to CPI. It has now been over a year since savers were able to beat inflation, but over this period interest rates have been on a steady rise. This means savers coming off a fixed deal or who are comparing their existing variable accounts to the latest top rates could find a more attractive return. The Bank of England’s forecast for inflation is to float around 6.6% during Q2 2023, which is far above the current 2% target. If inflation was at 2%, savers could beat it today with a fixed bond or fixed ISA.

“Savers who decide to fix a lump sum for a year will find the top one-year fixed bond rate is much higher than the top deal seen a year ago, which paid less than 1%. As interest rates fell to record lows in 2021, it’s refreshing to see such improvements across the savings spectrum this year. Along with the rising cost of living pressures, savers will find better returns but fixing for the longer-term may be too much of a commitment. Consumers may be wiser to spread their cash across easy access accounts and short-term fixed to secure a guaranteed return but also have a portion of their money ready to access in case of emergencies or to cover unexpected costs.

“In such a volatile market, keeping abreast of rate rises is crucial for savers as there is no guarantee that table-topping accounts will stay on the shelf for long. The market is continuing to flourish due to competition from challenger banks and building societies, coupled with the back-to-back Bank of England base rate rises. However, loyal savers may not be benefiting very much, or at all, so it’s wise to compare offers and switch.”

These rates are only not in relation to childrens savings accounts.

Savings rates – will they continue to increase

Is now a good time to move your money or should you wait for more interest rate rises? This is the big question, some of the rates now look good but will they increase to 5% or even more in the winter.

The current bank rate is 1.25% next due 4th August 2022. The consumer price index inflation is expected to rise to over 11% in October. Whatever you choose to do, make sure your savings are taking advantage of the interest rates on offer, if not just to balance with inflation costs.