The latest economic news is still bleak for retirees with interest rates predicted to rise again so if you are in debt then seek help.

Are you claiming entitlements - check here

Older people still not claiming entitlements as McCarthy & Stone helps its home-owners claim over £600k in 12 months

Up to 1.6 million older people failing to claim up to £2.8bn pension credit in UK. Benefits advice service offers tips so retirees don’t miss out

Pensioners on low incomes are still not claiming many of the benefits they’re entitled to reports McCarthy & Stone, the UK’s leading developer of retirement apartments. Through its benefits advice service, the company has helped over 200 customers in the past 12 months find unclaimed benefits totalling over £600k.

With figures from Department for Work and Pensions (DWP) indicating that up to £2.8bn* in pension credit is not taken up, it is thought that about one in three of those eligible are still not claiming it. Pensioners should carry out a full benefits check including state pension, pension credit, attendance allowance, disability, council tax, health, winter fuel, TV licence and warm home discount scheme.

McCarthy & Stone is advising that a low awareness of the range of benefits older people are entitled to, as well as a fear of talking to strangers about money problems is why many pensioners are struggling to cope with their finances and claim the extra cash. The company’s Benefits Advice Service is provided free and confidentially to its customers on request.

Colin Cuthbert, Benefits Advisor for McCarthy & Stone, offers the following tips to help pensioners check if they are entitled to more financial support. Even if retirees are not eligible now, they should also remember they may be entitled to receive certain benefits once they have moved into retirement accommodation, or if their situation changes in the future.

Guaranteed Pension Credit

There are two elements of pension credit – Guaranteed Credit and Savings credit, so you may be entitled to receive one or both of them. Guaranteed Pension Credit may be paid when you reach the qualifying age. It tops up your weekly income to a guaranteed minimum if it’s below £145.40, or £222.05 for a couple. These figures can also increase if in receipt of disability/careers benefits and/or if you are liable for ground rent and service charges.

Savings Credit

Savings Credit is an extra payment for those who have saved some money towards their retirement for example a pension and you may be able to get it if you are aged 65 or over. You may also be entitled to Savings Credit as well as Guaranteed Pension Credit. This could be worth up to £18.06 per week for single people, or £22.89 for couples.

Attendance Allowance

Attendance Allowance is also one of most frequent benefits pensioners fail to claim. This is a non-taxable benefit for people living at home aged 65 and over who need someone to help look after them because they are physically or mentally disabled and is a non-means tested benefit.

The name given to this entitlement is confusing as it implies that you need to have someone actually looking after you at home to benefit. This is certainly not the case. A typical successful applicant for this entitlement will be over 65 years of age who through illness or disability occurring for at least the last 6 months requires help with personal care, support or supervision. What matters is that you need the help, not whether you are actually receiving it.

There is not a list of illnesses or disabilities which determine who will and who will not receive the Attendance Allowance but special rules do apply for certain conditions including blind and terminally ill applicants. Successful eligible applicants can receive £53 paid weekly, often if needs are limited to day time and £79.15 weekly if your needs are for day and night. Applicants have to submit an Attendance Allowance Claims Pack.

Council Tax Benefit

This may be met in full if you qualify for the Guaranteed Pension Credit. There are possible discounts if you have a low income and you can receive a 25% discount if you live on your own. You may be entitled to a reduction in Council Tax if you are disabled or have a disabled person living with you.

Personal Independence Payment/Severe Disability Premium

Personal Independent Payment is a non-taxable benefit for people who have become disabled and make a claim before 65. It is non-means tested. Severe Disability Premium, if you receive a qualifying benefit such as Attendance Allowance or Personal Independence Payment you may also qualify for a premium on top of the basic personal allowance known as Severe Disability Premium.

Comments Colin Cuthbert, Benefits Advisor, McCarthy & Stone: “Most of the people we help have never claimed anything extra in their life, but we explain that they’re entitled to investigate their options. These can make a real difference to many older people who have been struggling to meet the rising cost of living and didn’t know they could get some extra help. We’ve spoken to over 800 people about benefit entitlement in the past 12 months.

“Anyone aged 60 or over in England should also know they’re eligible for free NHS prescriptions and sight tests, but many residents who receive Guaranteed Pension Credit don’t realise that this automatically qualifies them for help towards NHS health costs too, so they can get free NHS dental treatment and a voucher towards the cost of glasses or contact lenses. They can also receive help with essential travel costs to receive NHS treatment if referred by a Doctor or Dentist, or need to see a Consultant.”

Residents who live in a McCarthy & Stone apartment can arrange a free and confidential review of benefits they are entitled to by contacting its benefits advice team on Freephone 0800 027 2445.

*Figures from DWP, latest figures refer to 2009-10.

Content credited: McCarthy & Stone - July 2013

Retirement Matters note: for those not able to use McCarthy & Stone service, please visit www.gov.uk/benefits-adviser , we found this website easy to use - don't miss out on any entitlement !

Keeping Fit

Rotary Watches partnered with Prostate Cancer UK to launch the 1IN8 watch, a limited edition watch that highlights that 1 in 8 men are diagnosed with...

Earn extra income or passive income during retirement. Become a writer or find work that you enjoy working with animals, traveling the world or in...

Jim Smith, 92, observed the coronation of King George VI 1937, attended Queen Elizabeth II’s in 1953 now King Charles III the third coronation he...

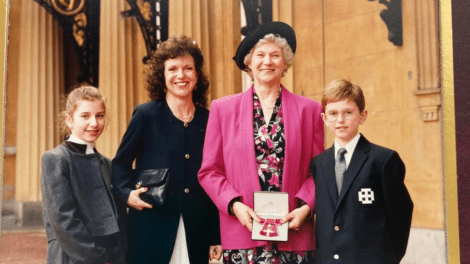

Two inspirational retirees share their stories and advice for younger generations on International Women’s Day. Be inspired for International...

Pension's Bee Impact Plan is an innovative pension offering enables savers to invest in companies that are building a better future for our planet...

Cheshire care home launched nutritional scheme based on the TV series, 'Care Dine With Me', whereby residents rate their meals as part of a new...

Collagen powder is the best-kept secret for combating the effects of the ageing process and can help to ensure your reaping the benefits as you get...

Research by property maintenance solution provider, Help me Fix, has highlighted five maintenance tasks that homeowners need to consider...

The worldwide demise of leadership skills due to covid-19 creates an opportunity for authentic leadership. A new leadership survey conducted by MTD...