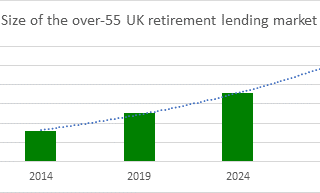

New research from the Centre for Economics and Business Research (Cebr) commissioned by equity release lender, more 2 life, has revealed the later life lending market is set to almost double over the next decade.

The Later in Life Lending Report shows over-55s will owe £295bn in 2019 and this is set to increase to almost double to £548bn by 2029:

Key Findings from Later in Life Lending Report

- In 2019, over-55s will owe £295bn, rising to £397bn in the next five years

- By 2029, this is projected to reach £548bn

- Over-65s will each be £16,500 in debt by 2029

- In 2019, the 65 to 74-year-olds will only have £3,100 left to save or invest at the end of the year once income and expenditure have been taken into account showing they have a worryingly small financial safety net

- Almost half of retirees (48%) said they would struggle to cover an unexpected bill of £5,000 and 35% said their expenditure exceeds their income

35% of retirees said their expenditure exceeds their income

85% increase of debt over a decade

By the end of 2019, lending is expected to reach £295bn – rising to more than half a trillion (£548bn) by 2029. This amounts to an 85% increase over a decade, suggesting that while the amount of debt is continuing to grow at a worrying pace, it has actually slowed down slightly. In 2014, over-55s owed £200bn and are predicted to hit £397bn by 2024 – a 98% increase over a 10-year period.

Total of £91bn of debt by end of 2019

While older age groups in this demographic fare better, the report also finds that the over-65s market will accumulate a total of £91bn of debt by the end of 2019, an increase of £5bn on last year’s findings.

This is expected to increase by a further 117% in the next 10 years, reaching £199bn by 2029. A combination of factors is likely to be driving the growth in amount of later life lending including:

- increase in older households,

- rising house prices resulting in higher mortgage values, and

- consumers who are increasingly comfortable using unsecured credit.

The lowest amount of net yearly savings

Analysis also suggests that the 65-74s have the second lowest amount of net yearly savings (£3,100) after expenditure and income have been taken into account.

This is just over 60% lower than those aged 50 – 64 (£8,100) and only slightly higher than those under 30 (£3,050).

With a typically fixed income and just £3,100 on average to meet future costs or put into a savings account, the older generation is particularly vulnerable to sudden unexpected costs or increases.

Indeed, almost half of this group (48%) believe they would struggle to cover an unexpected bill of £5,000 and 35% say that their expenditure exceeds their income.

Homeowners aged 65 – 70 owe an average of £120,000

Other key findings from the research include:

- 14% of over-55s surveyed have a mortgage on their property; 68% of these individuals report having a repayment mortgage, compared to 23% with an interest-only mortgage.

- Homeowners aged 65 – 74 who are still paying off a mortgage owe an average of £120,000. This is higher than the average for 55 – 64-year olds currently repaying a mortgage (£113,000). Those aged 75 – 84 who are paying off a mortgage owe over £78,000 on average.

- In 2012 there were 3.2m interest-only mortgages outstanding, falling to 1.7m in 2017 – a 46% decline. The total value of outstanding interest-only mortgages was £250bn in 2017, down from £400bn in 2012.

Dave Harris, Chief Executive Officer at more 2 life, comments:

“With more people buying their first homes later in life and the increasing use of unsecured debt, we are finding that more people are entering retirement still committed to ongoing repayments. While this might be something that can be managed while someone is working, it is harder to sustain when you are on a fixed income.

“We expect to see this trend continuing and by 2029, over-55s will hold £548 billion worth of debt. Not only are we seeing debt levels increase, but 65-74 year olds have just £3,100 left at the end of the year to save, invest or use to meet any unexpected expenses or manage additional costs. This is a worryingly small safety net and suggests that managing debt in later life may well become the norm for some people.

“One potential solution to this – and other issues facing over-55s who are trying to make their incomes last for increasingly longer retirements – is to consider how their housing equity can help. Later Life lenders have stepped up to this challenge and we are seeing increased flexibility as well as a wider choice of products designed to cater for today’s retirement lending market. However, we must ensure that we do not become complacent and with growing numbers of consumers interested in how they can access their housing equity, it is up to us to lend a helping hand to ensure they are able to enjoy the retirement they deserve.”

Do you want to retire owing money?

The prospect of retiring still owing money is not something we want to contemplate. Retirement should be a time of living, worry-free, and achieving those dreams we create during our stressful working life.

There are options to help you service your debt:

1 – Equity release

According to Key’s Q1 Market Monitor, a staggering £840m of equity was released by new customers – of which 35% used it to repay debt and 28% used it to clear outstanding mortgages – so it is clearly one solution that is growing in appeal.

2 – Seeking expert financial advice

We can not stress enough the importance of seeking financial advice. For those needing a helping hand when reviewing options, there are dedicated specialists who can take a holistic view of your finances and guide you to the best product to suit your needs now and in the future.

Make sure the adviser you chose has the right qualifications. Ask for references upfront and research companies they plan to work with carefully.

Websites such as Equity Release Council can provide information for customers who are looking to find a specialist financial adviser, but not sure where to start.

Whatever route you take, whether it is equity release, retirement-interest mortgage or something different, financial advice is going to be beneficial, especially as the number of retirement lending options grows.

3 -Prepare and plan before retirement

If you have not yet reached retirement, now is a good time to learn about options, seek advise sooner rather than later.

Speaking to an adviser in your 40’s and 50’s you can start you off think tactically about how to manage finances in the run-up to retirement and how to retirement effectively.

Seeking advice early will ensure borrowers are aware of the solutions that are available to them, should they need to overcome any financial obstacles later on.

Research services such as PayPlan and Stepchange for help and advice if you do not own a property.

Find out more at More To Life Equity Release.